You may be wondering why I haven’t blogged since May. Well, I’ve been working on something special. This semester, I’m teaching a new graduate-level class at the London School of Economics titled Public Policy for Blockchains and Digital Assets for students from the School of Public Policy and wider LSE.

It’s going to be extremely fun. The class will touch on important questions like what is the financial system, what does it do and how does “crypto” fit in? How should policymakers respond to the emerging crypto ecosystem? If you’re curious about the class, this post is for you.

What’s in the Syllabus?

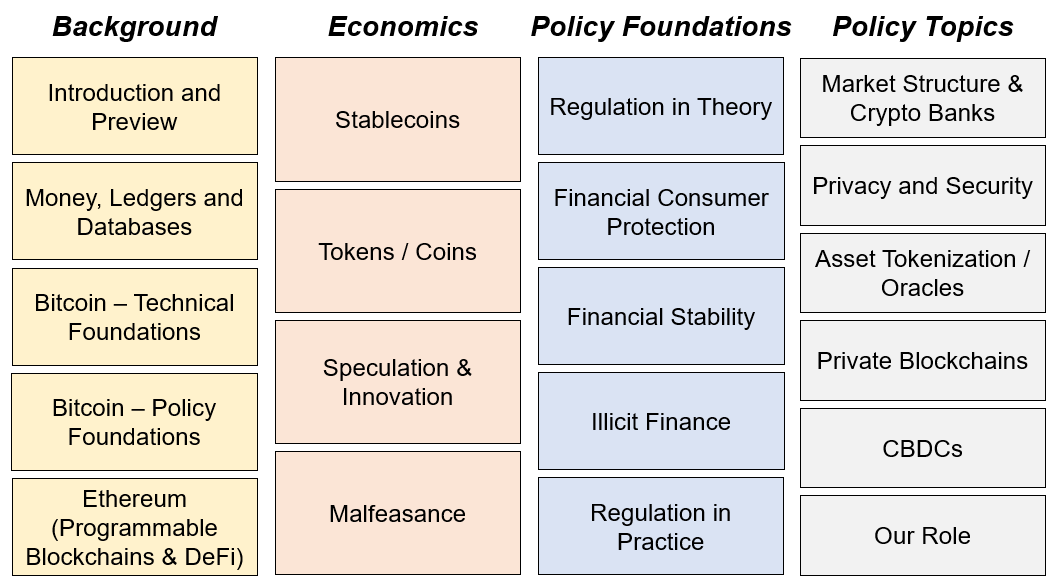

The course is split into four pillars and twenty lectures:

The Background pillar covers the technical foundations of “crypto.” Students will learn what kind of database a blockchain is, how and why it uses cryptography, what it means to be “censorship resistant” and the other properties that make major blockchains different from bank databases (like being public, permissionless, pseudonymous, immutable, having low throughput, high fees, no password recovery, etc). Students will also learn about the basic financial lego bricks that can be built with “smart contracts” (e.g. lending, exchanges or derivatives) and how these legos can be “composed” into more elaborate financial products. This is known as “decentralized finance” or DeFi.

The Economics pillar is about what the assets and systems that live on blockchains are and what they’re used for. It covers stablecoins (fully backed, overcollateralized and algorithmic) and why there’s demand for them (as “chips” for speculation and synthetic dollars in gray/black jurisdictions). It covers crypto “tokens” (native, utility, governance, NFT, etc), what they’re used for and how they compare to their traditional finance equivalents. It covers the economics and social psychology of innovation, speculation, and speculative bubbles and also the types of malfeasance that occur on or with crypto (ponzi schemes, pyramid schemes, “pump n’ dumps,” money laundering, illicit finance, etc).

The Policy Foundations pillar opens with the theory of why governments ought to regulate and why they do regulate. We then cover three key policy areas. The first is consumer protection, which is everywhere in our financial lives (from mortgages to pensions to banking) and should be in crypto too. The second is financial stability, a crucial public good that could be threatened by crypto’s volatility. The third is financial crime (money laundering and illicit commerce / payments) and how crypto is useful for it. We close with a lecture that covers the legislative inaction in the US, Europe’s Markets in Crypto-Assets regulation, the UK’s effort to be a “Web3 leader” and the worrying role of “offshore” jurisdictions like the Bahamas.

Policy Topics, the last pillar, is a mix of interesting issues. We compare the structure of traditional securities markets with centralized crypto exchanges (Binance is simultaneously a custodian, prime broker, exchange, market maker and hedge fund). We look at the crypto shadow banks (e.g. Celcius, Voyager etc) that take customer deposits and are either straightforward ponzis or don’t have adequate risk management or oversight. We look at privacy and security on blockchains (both are deeply flawed) and the promise and obstacles to tokenizing real-world assets like securities and real estate on blockchains. There’s a lecture on private permissioned blockchains (for corporates like Walmart or Maersk) and a session on Central Bank Digital Currencies, which are arguably a reaction to crypto (and Facebook’s now-abandoned Libra/Diem stablecoin).

And that’s it. That’s the class!

By the end of the semester, students should be able to communicate the economics and technology behind “crypto” and educate specialized and layman audiences about it. Students should also gain the tools and skills to evaluate crypto assets, products and systems and weigh the tradeoffs, opportunities and risks with analytic frameworks from economics and other social sciences. Most importantly, students should develop informed views about how crypto regulation should evolve.

Why Teach It?

You may wonder why an avowed crypto-skeptic would teach all this. It boils down to a few things. First, “crypto” is endlessly fascinating. Piercing through the technobabble and zealotry is a lot of fun.

Second, because LSE hosts students from all over the world, including dozens of developing countries where crypto is entirely unregulated. Many of these students are going home to roles at their finance ministries, central banks and other regulators where they'll shape economic policy for the better. When presented with dubious ideas (like investing pension savings in DeFi “yield farms”), they should be able to cut through the hype, see the risks and opportunities clearly and respond effectively.

Third, because crypto is here to stay in one form or another. Despite the failure of Terra/Luna, FTX and the daily hacks, bitcoin is still worth over $25,000 and still has liquid markets against local currencies almost everywhere. There’s real, non-speculative demand for stablecoins from tens of millions of people around the world that can’t open USD bank accounts and there’s demand from all the gray/illegal activity that crypto facilitates because it’s censorship resistant and exists outside the regulatory perimeter.

Journalists and commentators have written 474 “obituaries” for crypto so far, but the technology just refuses to go away. The space is and will remain relevant for many years to come, despite how self-referential and absurd it all seems. Policy students that want to learn about it should have the choice to.

Lecture one is in less than a week. I can’t wait.

PS: I’ll post an update in December, once the class wraps up.