Can Bitcoin "Fix" El Salvador's Economy?

The answer is not obvious to many cryptocurrency enthusiasts.

El Salvador’s economy has been anemic for the past thirty years. The country hasn’t diversified past textiles and agriculture, crime and violence remain extremely high and tens of thousands of Salvadorans still emigrate every year. Can bitcoin adoption jumpstart the country and begin to reverse these trends?

Unfortunately, no. The sluggishness of El Salvador’s economy stems from deep-rooted issues unrelated to its currency. Adopting a new kind of money is unlikely to shake the country out of its low-growth equilibrium and raise overall living standards.

1. A (Very) Brief Economic History of El Salvador

To understand the present-day El Salvador, it’s crucial to understand its past. In 1979, a brutal civil war broke out between the country’s U.S. funded right-wing government and the FMLN, an umbrella organization of left-wing groups and guerrillas that were partly armed and trained by the Soviet Union. The conflict lasted twelve years until peace accords were signed in 1992 and claimed an estimated 75,000 lives.

Per capita GDP in El Salvador (a proxy for household income or average living standards) was just 11 to 12% of U.S. per capita GDP before the civil war, meaning Americans in the 60s and 70s were almost ten times richer than Salvadorans. However, incomes in El Salvador plummeted to 6 to 7% of the U.S. level with the conflict, as shown below. The country was never able to recoup the losses, as the flatness of the blue line suggests.

Over half a million Salvadorans left the country for the U.S. in the 80s and up to seventy thousand more emigrate fleeing violence and unemployment every year, explaining the 2.3 million Salvadorans that live in America today. Emigration has cut population growth and reduced labor market dynamism, but has also led to massive remittance flows worth US$ 69 per person per month or 20% GDP.

In the 1990s, El Salvador stopped relying as heavily on coffee and other agricultural exports (in yellow) as its nascent textile sector (green) took off and its service sector (blue) began to expand. As a result, the country rose somewhat in the economic complexity rankings.

However, no new major export sectors have cropped up in the last twenty years. El Salvador has continued selling textiles with growing competition from places like Bangladesh and Vietnam and has not been able to diversify into higher value-added activities that support high-paying jobs.

The lack of diversification is not surprising considering El Salvador’s low public and private investment, which totaled just 16% of GDP in the last decade, compared to 23% in Honduras, 25% in Nicaragua and 36% in Panama.

2. El Salvador’s Economy Today

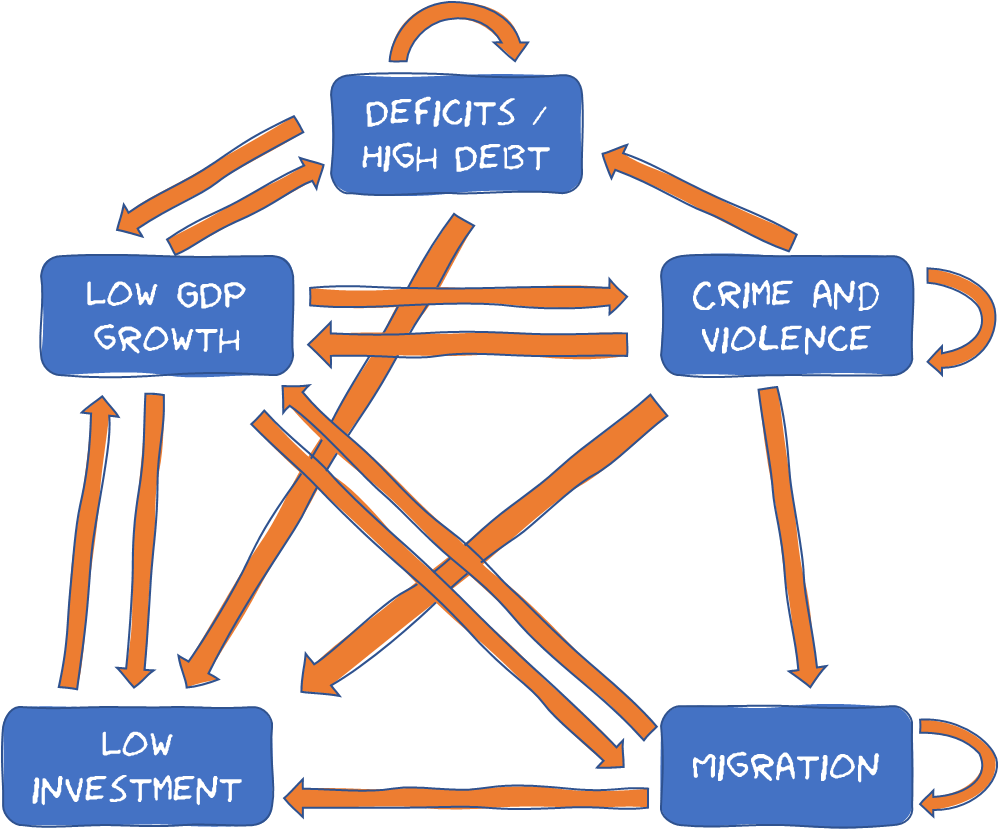

Today, El Salvador’s economy is stuck in a maddeningly stable, low-growth equilibrium. As the orange cause-and-effect arrows in the diagram below illustrate, low GDP growth, large deficits and high debt, high crime and violence, low investment and emigration are all related to one another in complex and mutually reinforcing ways.

High crime and violence, for instance, pressures the government to spend more on policing, security and the military, which in turn leads to large deficits and a lot of expensive debt. El Salvador currently has almost 90% of GDP in debt and pays 6% average interest on it, a rate four times higher than the 1.5% the U.S. pays federally. As a result, interest expenses are 5% of GDP and 15% of total government spending.

High debt service, in turn, diverts resources from public investments in infrastructure, education and other areas (which are just 3% of GDP) and potentially also discourages private investment via higher actual and expected taxation. The underinvestment is serious. Annual interest expenditures have been larger than public investment every year since 2017.

All this, of course, feeds back into low GDP growth, which leads lower job creation, more crime and violence, security spending pressures, high debt and deficits, low investment, low GDP growth and on and on… There’s more to the story than this complicated vicious cycle, but the self-reinforcing nature of the low-growth equilibrium is real and extremely difficult to break out of.

That’s why a succession of right and left-wing governments has been unable to catalyze an economic turnaround. It’s also part of the reason why the country has been unable to attract private investments in new, higher-productivity export sectors that can support good jobs.

3. Bitcoin Adoption

Can bitcoin adoption shake the country out of this rut? Not obviously, no. The chivo wallet and lightning network have made bitcoin decently functional as a medium of exchange in some parts of El Salvador, but the new currency and payment mechanisms don’t directly reduce crime and violence, stem migratory flows, curb high deficits and debt, raise public and private investment or accelerate economic growth. That’s just not what digital currency is designed for.

Without directly addressing any of the issues in the diagram that anchor El Salvador in the low-growth equilibrium, it’s just not clear how bitcoin could accelerate GDP growth. What is obvious is that bitcoin adoption has raised financing costs for the government by alienating traditional finance investors, bringing the country closer to insolvency.

Bitcoin beach and crypto conferences have promoted some economic activity in El Salvador, especially tourism, but it totals $5m per year (0.03% of GDP) according to the IMF. Even if the number is twice or four times as high, this spending is not macroeconomically significant and won’t sustain a large number of high-paying jobs.

The largest purported benefit of partial bitcoin adoption is lower remittance costs. The argument is that moving money to El Salvador from abroad could become cheaper if senders and recipients use the lightning network, but so far, that isn’t happening much. Remittances in El Salvador are traditionally sent and received in cash and there simply aren't enough bitcoin ATMs in the U.S. or the country for bitcoin to be the corridor in the middle.

In any case, if the global average remittance fee of around 7% is lowered to zero thanks to bitcoin adoption (extremely optimistic!), that would be a one-time 1.4 percentage point increase to El Salvador’s GDP. This best-case scenario of a permanent 1.4 percentage point increase to living standards would be great but it still wouldn’t accelerate long-term economic growth.

Cheaper remittances do not amount to a national economic strategy. They just boosts the level of GDP once and then stop having any effects. For cheaper remittances to raise steady-state growth, they would need to increase economic productivity or enable new export activities, which again isn’t plausible.

4. Misplaced Hopes

Unfortunately, bitcoin adoption is not only brining the country closer to insolvency and a debt crisis by raising borrowing costs, but it’s also hogging the government’s limited bandwidth away from the deep-rooted, structural issues plaguing the economy.

El Salvador’s economic problems are just not linked to its currency. The government and crypto-enthusiasts would do well to remember that.

[1] GDP per capita (constant 2015 US$) data was used for the calculations and chart. PPP adjusted real per capita income would have been more appropriate, but the WDI’s data for this variable starts in 1995 and does not capture the civil war period. Therefore, non-PPP adjusted data was used.

[2] SITC product categories were combined to simplify the chart.

[3] The diagram draws from and is broadly consistent with the IDB’s “Retos de Desarollo del Pais El Salvador” (2019), the World Bank’s Systematic Country Diagnostic (2015), USAID-El Salvador Constraints Analysis (2011) and “Growth Diagnostics'' by Hausmann, Rodrik and Velasco (2005).

Thanks for the article.

One interesting thing is that during the Cold War, the US government would often support and promote political actors and systems that were not free-market capitalism but about more (right-wing) government control and nationalisation

the way you've managed to break down a complex economy in simple terms is awesome for the reader!

a very sobering explanation on what seems to be a "breakthrough" in mainstream narrative.

a few questions:

under what conditions can fiat and cryptocurrencies co-exist in a nation-state economy? how would the cross-currencies dynamics play out for this to be feasible, stable and suited for a nation's economic growth? or is crypto to be transacted solely by Internet users (and a hypothetical, emergent network-state)?

fenómeno Frank!! un abrazo grande.