Central African Republic Adopts Bitcoin Without Internet

The Central African Republic made cryptocurrencies legal tender. What does that mean if internet access is severely limited?

The Central African Republic (CAR) recently became the second country after El Salvador to make bitcoin legal tender. To their credit, the reform is quite modest. Unlike El Salvador, the Central African Republic hasn’t signaled it will buy bitcoin with taxpayer money, force businesses to accept bitcoin or roll out an expensive app with incentives for new users. They just made cryptocurrencies legal tender. In this post, I’ll unpack what that means.

For context, the Central African Republic has been ravaged by coups and civil war for decades. It’s a landlocked country of 5M people where about 70% of the population lives in extreme poverty (less than $1.90 per day1), where one in four people don’t have basic sanitation or even pit latrines to go to the bathroom and where one in twelve children die before age five. Its ranking in the Human Development Index2 is the second lowest in the world.

As with most low-income countries, agriculture plays an outsized role in the Central African Republic, employing 70% of all workers and totalling 30% of GDP. This is not high-tech, mechanized industrial agriculture like in the United States, Israel or Uruguay. It’s extremely low-productivity, smallholder agriculture like in Ethiopia and Liberia, where a bad harvest means months of hunger.

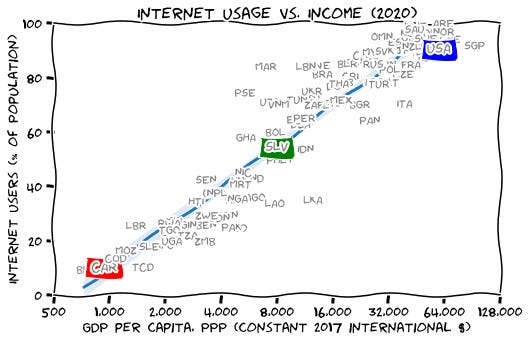

As the chart below shows, the Central African Republic (in red) has a GDP per capita of just under a thousand dollars. For reference, El Salvador’s GDP per capita (in green) is about eight times higher and the US’s GDP per capita (in blue) is about sixty-four times higher. These are staggering differences in living standards. Just 10%3 of the CAR’s population uses the internet on PC or mobile, one of the lowest ratios in the world, according to the International Telecommunications Union (ITU).

Without internet access, most people won’t be able to use or “adopt” bitcoin. This is true even if the ITU is underestimating internet access by a factor of two by undercounting mobile users. In this sense, the legalization of cryptocurrencies seems mostly irrelevant. So what does President Faustin-Archange Touadéra hope to achieve?

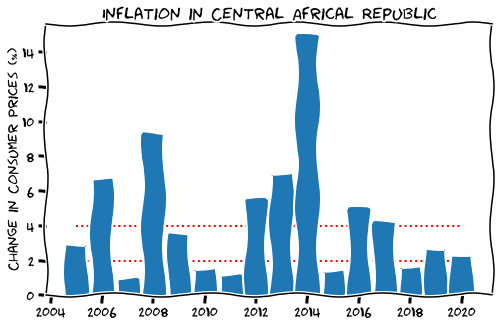

Honestly, it’s not clear. The country has a functional currency, the Central African Franc (CAF). The CAF is pegged to the Euro, does not fluctuate much in FX markets and is used and jointly managed by a group of six neighboring countries4. Inflation in the Central African Republic has been somewhat volatile, but that’s due to civil war and internal conflict, not monetary mismanagement. Annual price increases have stayed in or around the 2-4% range since 2015:

Wanting to replace the rigid regional currency with sovereign fiat money would be reasonable. It would give the domestic central bank control over monetary policy, an important tool in modern economic management. But legalizing cryptocurrencies that can’t be controlled by the government doesn’t seem to accomplish much from a macro policy perspective.

If I had to guess, there are at least two rationales at play. Most importantly, the president has been “orange pilled.” He is convinced that bitcoin and public blockchains are the future of money and thinks that drawing international attention to his country by legalizing cryptocurrencies like El Salvador can’t hurt. His tweets certainly suggest this:

Second, legalizing crypto may offer advantages for the small subset of urban internet users. Over time, the country might be able to use free crypto apps to offer basic financial services (like a digital wallet) that domestic banks don’t or can’t offer. To the extent that the country goes online, that may increase the share of people with access to savings vehicles. Of course, transaction fees will need to fall to the single cents per transfer for crypto payments to ever take off.

Needless to say, getting people into crypto is risky. The short term volatility of bitcoin (on the left below, in red) is extremely high and isn’t trending down. A normal daily movement for Bitcoin is 4-6%, compared to less than 1% for the Euro and the British Pound. Bitcoin’s long term price movements (in black on the right) are also extreme. Even though every tick on the y-axis doubles the price of bitcoin, the vertical movements are still wild.

Citizens encouraged to buy crypto by this reform might lose money like President Bukele of El Salvador, who is down $30M in taxpayer dollars on his $100M bitcoin investment. (To be clear, CAR’s authorities have not signaled they want to buy cryptocurrencies with public money). Encouraging the use of a fully backed Euro (or USD) stablecoin rather than bitcoin is probably a better idea.

From the outside, it seems like CAR should focus on managing domestic security threats, getting more external aid and crucially, increasing agricultural productivity. Legalizing crypto isn’t inconsistent with those goals, but I do worry that the President and legislature are spending their limited bandwidth on extraneous reform, rather than on security and policies to help people get better seeds, fertilizers, irrigation and paved roads to access markets.

While 80% or 90% of the population doesn’t have internet access, adopting cryptocurrencies as legal tender won’t have major effects. The reform put the Central African Republic in the spotlight and might give a small subset of the population new tools for saving, but there are big risks. I would hate for people in one of the poorest countries in the world to lose what little money they have if crypto prices drop again.

Constant 2011 US$ PPP

The ITU doesn’t gather primary data and survey representative samples of the population in each country to ask about internet use — that would be expensive! Instead, they extract information from standard household surveys that are already conducted by national statistical agencies. Every national statistical agency asks different questions with different wording about internet access, so mobile devices won’t be counted consistently across countries. As a result, the data probably understates internet access in developing countries.

Cameroon, Chad, Congo, Equatorial Guinea, Gabon and the Central African Republic

very interesting, especially the "orange pill" reference which i don't really buy because very similarly to el salvador african countries are renowned for the rampant corruption, political instability, poverty, war and violence, and a predatory culture of plundering of local resources by both locals and foreigners. so i think the bitcoin revolution by pseudo governors, like the corrupt president of el salvador nayib bukele, falls more in line with creating a mechanism to launder all the money from their corruption and ties to organized crime and evade the international financial control systems. although it is important to emphasize that the central african republic IS NOT wasting public tax payer money to help bitcoin whales unload when the price of bitcoin is high to make a profit at the expense of the public taking the loss, just like it has happened in el salvador. in poor countries like el salvador and the CAR those funds are desperately needed in key areas such as schools, hospitals, roads, etc. where they may get some value in return for that money. another point of comparison between the CAR and el salvador is the fact that before the corrupt government of nayib bukele took control of the congress, the supreme court and the attorney general office, guess what, bitcoin was already being used in el salvador for small, daily transactions at el zonte beach as part of an experiment called "bitcoin beach" without the need to make it legal tender by law and spends hundreds of millions of dollars to implement that law and even speculating by buying bitcoin at record high prices. keeping in line with the core concept of bitcoin it made far more sense for everybody, the country, the people, the public's finances and economy, bitcoin and bitcoiners themselves; that things had been kept the way they were and allow for true, free market dynamics to dictate the natural, organic process of bitcoin adoption in el salvador. contrary to that logic the corrupt government of el salvador, after the coup where the supreme court was removed by the new congress loyal to the president, the bitcoin law was imposed on the population and hundreds of millions of dollars burned to implement that law. it is also important to mention that since el salvador has been a highly indebted nation since always, those hundreds of millions of dollars used to implement the highly unpopular bitcoin law came NOT from the country's own savings but from loans that HAVE to be repaid at high interests. so the president of el salvador has gambled away public money that was borrowed and now in spite of the losses has to repay with interest. and finally, the majority of the people in el salvador DO NOT use bitcoin nor the government stable coin app CHIVO, nor do they care nor want to know anything about bitcoin. even the government has stopped promoting it through its aggressive propaganda machine and troll farms. just take a look at chivo's twitter account posts, for example. the bitcoin experiment in el salvador has been a flop except for one purpose in particular, to launder all the illicit money from official corruption and the president's connections to organized crime. if you don't believe it look up nayib bukele's nexus with local mob leaders like jose luis merino, herbert saca, the orozco family, pablo anliker, etc. they're the ones cashing out on the governments bitcoin laundromat.

I order to reap the rewards of savings, you need to store your money in the best form of money possible. Bitcoin. One of the key advantages of using bitcoin is for quick international settlement and I am of the opinion the more trade the richer CAR will become.